Have the latest informative data on mortgages, domestic collateral, and you may refinancing in the mortgage brokers blogs. First-time homebuyers and you will experienced home owners exactly the same will get beneficial and you may most recent information regarding the fresh wider arena of financial financing.

As manager from a cellular house, you’re currently well-aware finance companies you should never well worth your property just like the highly while they create if it have been a classic house. This may be as https://paydayloanalabama.com/broomtown/ to the reasons you are thinking in the domestic guarantee: do i need to score a property collateral financing back at my mobile house?

It’s a question. If you’ve kept up with fix on your own cellular house and today you are wishing to cash-out (or you are looking in order to snag property equity product to redesign the twice-wide), you will be examining their additional HELOC and you will domestic collateral mortgage solutions.

You’ll want to individual residential property.

If your rent a space during the a mobile home playground, you won’t be able to get a property equity equipment — even if you very own your mobile house. Is why: Banking institutions examine mobile property due to the fact individual assets (such a car or truck) in place of property (particularly a home). It means the mobile home will generally depreciate inside the really worth only instance a new auto does once you push it off the lot.

not, for people who individual the newest homes where their mobile residence is found, your home appreciates for the really worth throughout the years — definition there must be adequate worth on your own residential property and you will household mutual in order to qualify for a property guarantee product.

Extent you owe on the financial can not meet or exceed the value of the property. Simply put, you will need to have some security of your house already. To figure out when you have guarantee of your property, you will want the following pointers:

Your own house’s ount you taken care of your residence, it’s the current worth of your home — which is dependent on the real estate business overall. Discover a loose thought of the worth of your house, input the address and look at the newest rates on the Zillow otherwise Trulia .

The amount you continue to are obligated to pay on the home loan. Look at the amortization schedule observe exactly how much, together with charge like notice and you will PMI, you will still owe on the financial.

Make current worth, subtract everything you nevertheless owe, and that is give you a crude idea of your home security. Such, whether your house is valued in the $60,100000 and also you are obligated to pay $forty,100000, your property guarantee is around $20,100. It doesn’t mean you’ll be able to obtain a full $20,100, but it is a starting point having quoting that which you could well be able to find.

You’ll need a long-term basis.

Your cellular family will likely must be permanently attached to your land so you’re able to qualify for property guarantee loan system. This really is an element of the concept of a house becoming property as opposed to private assets given that a manufactured household who has got good towing hitch otherwise wheels connected is much more like an automobile than just property.

You have greatest luck with a dual-broad.

Though you could possibly score property collateral mortgage that have just one-wider trailer, extremely banking companies have minimal dimensions conditions so you can meet the requirements. This will depend into the lender, but due to the fact single-large residential property tend to be less (eight hundred square feet to at least one,100000 sq ft as the standard) they’re usually harder so you can secure a home collateral financing against.

Your own borrowing from the bank must be strong.

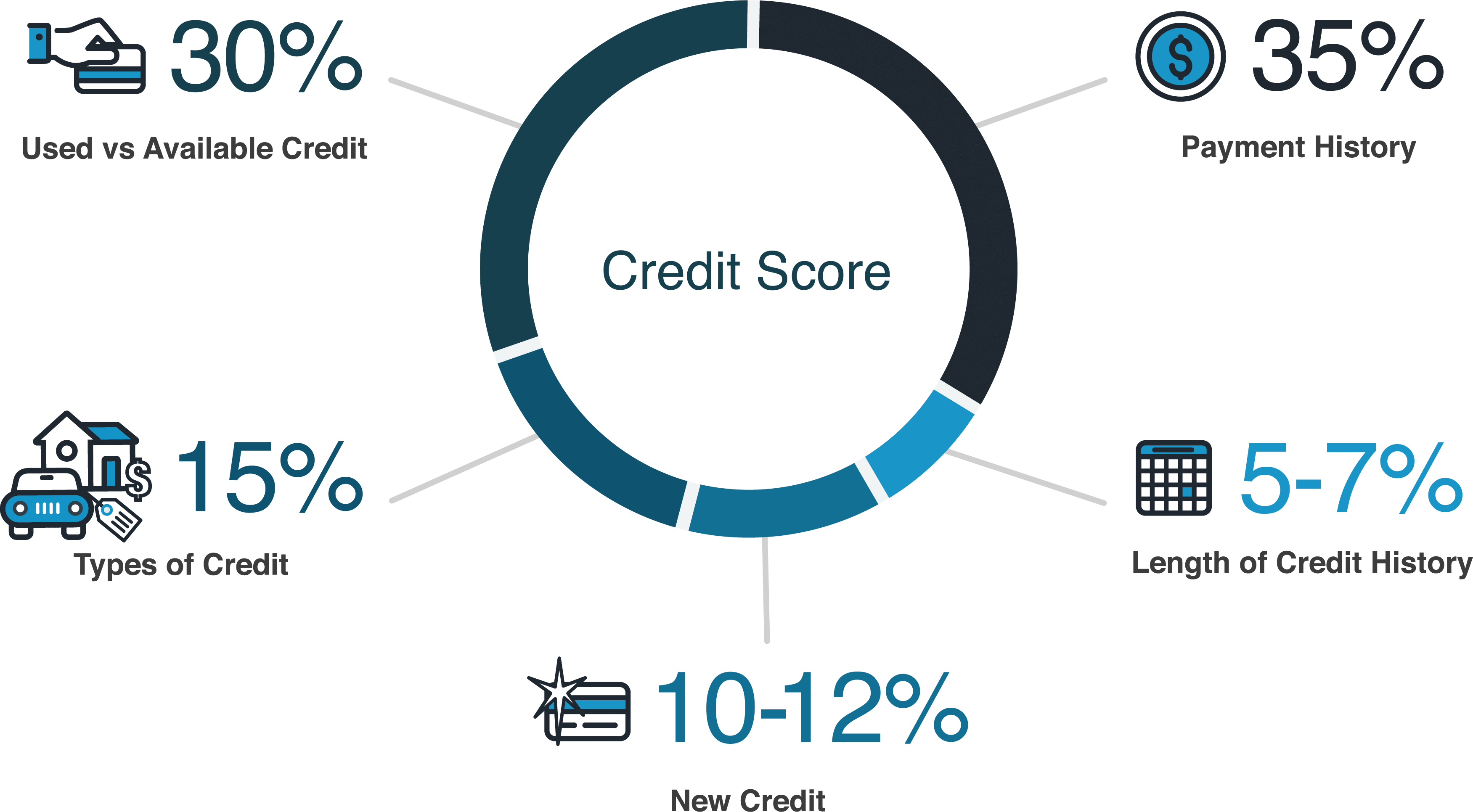

Just like which have people mortgage, a property collateral financing need good credit (620 otherwise above). Also your credit score, your bank look at your other debt burden when considering whether or not to accept you to own a home equity mortgage. When you’re poor credit by yourself wouldn’t always allow it to be impossible to get a property security financing, it can certainly succeed difficult to find you to definitely with an excellent interest rates.

You’ll have to see whether property collateral mortgage otherwise a good HELOC is best.

Their financial will assist explain the differences between the two sizes off home guarantee financing, however, right here he is in a nutshell. A property collateral mortgage are a second loan you to definitely services also for the brand new home loan: it is a lump sum the lending company pays your, you pay inside increments over the years. A HELOC is actually a personal line of credit, such a charge card, that you can use for the an effective revolving foundation.