Summation

- PennyMac Mortgage Capital Believe is actually a frontrunner in overall financing creation and 6th biggest financing servicer.

- The newest much time-term frame of mind for new originations includes beneficial manner during the domestic formation.

- The business’s mortgage upkeep section will benefit regarding all the way down prepayment pricing since mortgage pricing improve.

- Their dividend commission is now producing eleven%. At this particular rate, it would simply take an investor less than ten years to recoup the principal from the ground upwards over the fresh new bonus costs.

PennyMac Financial Money Believe ( NYSE:PMT ) is actually a reputable leader from the U.S. home loan field. These represent the prominent correspondent mortgage aggregator therefore the 2nd prominent during the complete financing manufacturing. On top of that, these represent the 6th biggest from inside the loan repair. As that loan servicer, the company advantages of recurring fee money over the lifetime of the borrowed funds, and this without a doubt increases in the a breeding ground which have ascending interest rates.

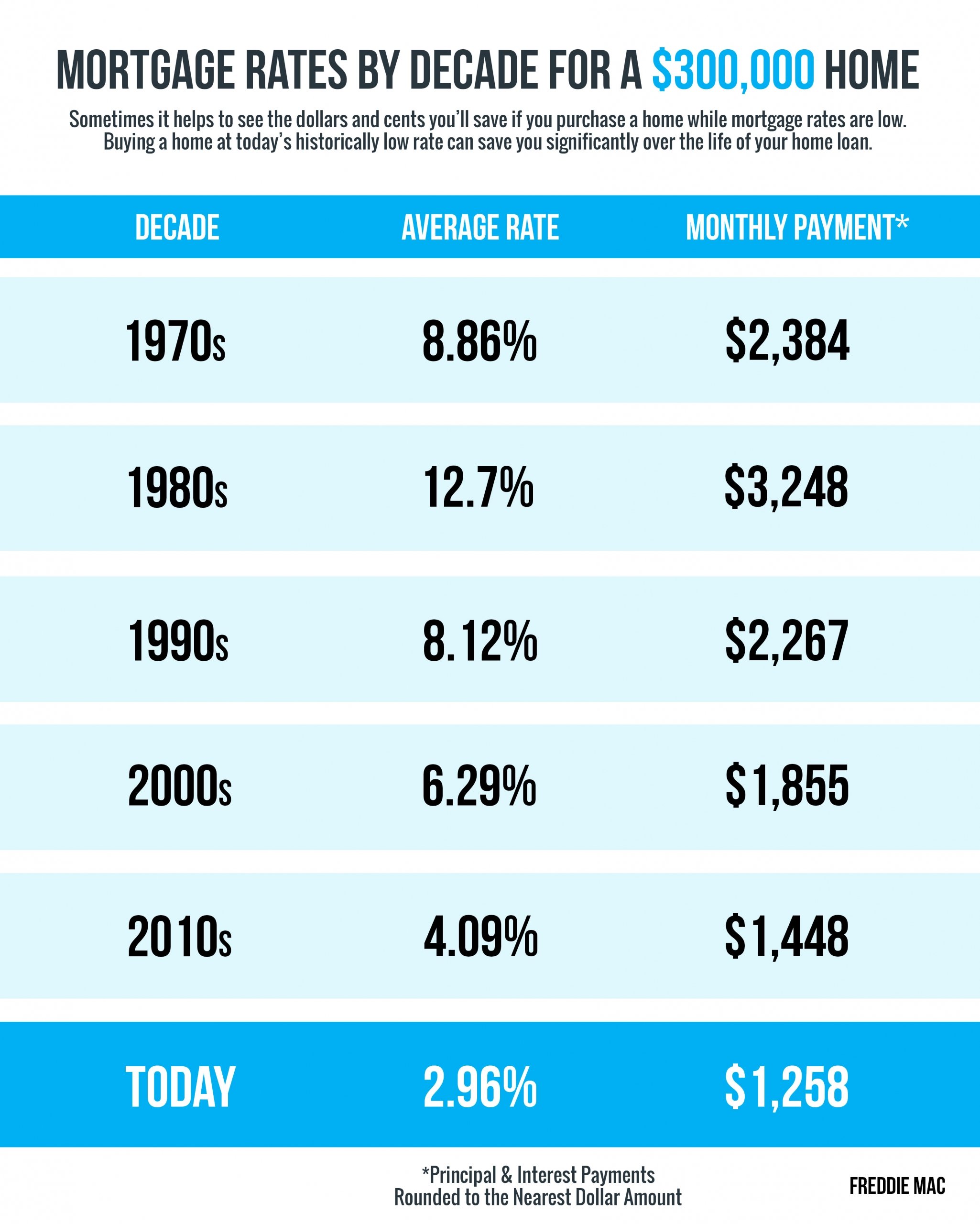

Just like the 2010, the U.S. enjoys added nearly 11M the latest house, yet , property supply was at a just about all-go out reasonable. Given that designers improve family completions, PMT can benefit about went on development in brand new purchasing business, passionate of the millennial age group within perfect real estate age. Regardless if interest rates is actually ascending, he is nonetheless on usually lower levels and property was somewhat less in debt than just they certainly were regarding age prior to 2010.

PMT happens to be exchange near its downs, additionally the share rates enjoys but really to return to their pre-pandemic accounts. The fresh bonus is yielding more eleven%, which is better more than other REITs and higher versus latest price from rising cost of living together with newest rates with the a danger-totally free I-Thread. An investment on company is risky considering the inherently state-of-the-art characteristics of the organization as well as their weak basic principles, however for investors with high standard of chance tolerance appearing to add a premier yielding mortgage REIT to their profiles, you’ll find tough alternatives available to choose from than PMT.

Team

PMT are a publicly traded REIT that works while the a specialized finance company you to recognizes money mostly courtesy its passions inside home loan-related property. The center company is inside the around three number 1 locations; Correspondent Development; Rate of interest Sensitive and painful Methods; and you may Credit Sensitive and painful Steps.

During the 2021, the business claimed $420M in total websites resource money. Since Credit Sensitive and painful Strategies phase accounted for most of the total in the current year, the brand new Correspondent Development section is generally the most significant driver regarding web resource activity.

On Correspondent Manufacturing section, PMT orders Company-eligible funds, jumbo funds, and family security credit lines. Then they offer the new Agencies-qualified loans appointment the guidelines out of Federal national mortgage association and you will Freddie Mac computer to your a servicing-employed base where they keep up with the associated https://paydayloancolorado.net/aguilar/ MSRs. MSRs portray the value of a contract one to obligates PMT to provider the fresh funds for the master of the loan in exchange for servicing charge in addition to straight to gather certain ancillary money about debtor. Along with financing development and you may welfare inside MSRs, PMT possess a credit risk import (CRT) plan with Fannie mae, in which they earn money through the sales off pools off fund into Fannie mae-protected securitizations.

With the origination, the brand new weighted average FICO rating away from consumers within their mortgage collection is actually significantly more than 750, which is over the federal average. Furthermore, this new get could have been steadily growing while the 2018 due to the fact property continue so you can deleverage and build right up its internet worth.

Around 40% out of total originations take place in five claims: California, Fl, Texas, Virginia, and you may Maryland. Off an area perspective, about thirty five% of total originations are located in the latest Southeast. Furthermore, the fresh new Southeast and Southwest, with her, account for 60% out of complete originations.