Jali-influenced Papercut Award

The delicate art of Jali carvings from India informed the artwork I chose to accompany the text of this award. The delicate papercutting was done on brown paper and mounted on a sheet of white paper dusted with pale yellow pastel chalk, giving the piece a softly mottled look. When I create these awards, I request as much information about the recipient as I can get so the piece is a perfect...

Read MoreA Ring of Precious Memories Ketubah

One of the things that makes my worklife joyful is meeting a couple who have a concrete wishlist and the willingness to hand me a shopping bag full of ideas! As you can see, this ketubah captures such a list, from references to the meaning of family surnames and histories, and from work life (can you find the Drosophila [fruit-fly!]) to a montage of Jerusalem images and a trip over the George Washington Bridge. All of this is tucked into a unifying ring of specific flowers capturing the predominant colors of blue, green, and purple. A total...

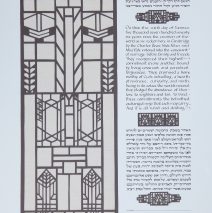

Read MoreFrank Lloyd Wright’s Light Screens Ketubah

This piece took a wonderful couple and their artist-of-choice on a fabulous visual journey. From the very first email contact, when they sent me some inspirations in the form of Mogul Jali funerary architecture – which I had been drawn to that very day when I saw an example while on a trip in the Sinai desert – I knew we were ‘right for each other.’ My sketches, their photos, my library searches, and many more sketches flew around the globe because the last 3 weeks before the piece was due found them working in a tiny Malaysian village where wifi was hit or miss, and where we had to plan for contact while everyone was awake! Truly an adventure. I learned so much more than I’d ever known about the craftsmanship of Frank Lloyd Wright as I sought out records of his glass work. I extracted small bits and pieces of a wide array of the master’s designs, and silently requested his forgiveness for messing with his ideas! Another touch was the inclusion of a repeating design from a window by Eliel Saarinen, chosen specifically by the bride and groom. When it was time to assemble the work, I carefully cut away the areas behind which the brown papercuts would be seated. This was quite a challenge for the three small designs that break up the sections of text since there had to be enough white paper for glue, but it had to be cut back far enough to be invisible to the observer! I had a framer mount fine wheat-colored linen on a board and then we mounted the text with papercuts on that to allow the subtle warp and woof of the fabric to echo the horizontals and verticals of the cut paper. The papercutting itself was done freehand with no metal rule. Each time I had to cut a long line, I took a deep breath and let it out s-l-o-w and controlled as I drew the knife through the paper. X-acto Z blades, a new product – WAY very sharp and strong – are the blades of choice. I buy them in boxes of 100 and don’t hesitate to swap them out if I feel there’s any loss of...

Read MoreTraditional Page of Learning Ketubah

Many couples go beyond the customary wording of a marriage contract to ‘wordsmith’ their own ketubot. This one features a deeply thought-out process whereby each concept that resonated with the couple as they considered their promises to one another was linked to a potent traditional teaching. The very layout of the document, with a core statement in the middle and ‘commentaries’ around that, shows an unbreakable link in the chain of Jewish learning and values. Delicate medieval and Persian designs in jewel tone colors with touches of raised gold leaf frame the...

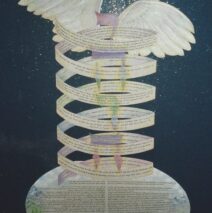

Read MoreWings of the Shekhina Ketubah

This is a very complex document, written not using a traditional Ketubah text, but instead built upon a Brit Ahava, (A Covenant of Love) written by Rachel Adler and published in her book Engendering Judaism. The text recounts the covenant God made with Noah, David with Jonathan, and God with the people Israel. It is a document of equality, love and devotion. What’s not immediately clear from the photograph is that the piece is crafted of cut and shaped paper: The lettering in the spiral, including the Tetragramaton, is overlaid on the text oval at the bottom and on the wings above. The wings! They are cut from hand-made Indian hemp paper, impressed with a bone folder and stuffed with batting from behind to give the wings a feeling of fullness! Tiny pin feathers are cut and lifted lightly to further enhance the dimensionality. Look carefully, too, at the lettering the the central part of the ketubah, to see the way the Hebrew and English hugs the curves and narrows at the outer margins to emphasize the nature of the spiral moving around and around the central core of the unpronounceable name of God. The background paper is a navy blue sheet set with tiny mylar ‘confetti’ that resembles the stars in an inky night sky. Mordechai says of their ketubah, “It hangs in our bedroom. Lynne and I over the years have reread the text many times. I look at the Ketubah daily and marvel at how the imagery still captivates...

Read More