Step four: Rating Money in to your Membership Within 24 hours

Step four: Rating Money in to your Membership Within 24 hours There isn’t any 100% ensure that your own instant 2000 financing could be approved, but there’s a guarantee that you will get a credit card applicatoin benefit in just 2 minutes. And suppose there isn’t any danger of a lender assisting you to. If so, we can make available to you alternative borrowing from the bank answers to imagine, including credit reports and you can borrowing resolve otherwise debt consolidating. Once you provide your support paperwork and the loan provider merchandise your with an agreement to consider, you should sort through most of the words and you can sign the brand new contract for the $2000 financing. This can be done digitally online. Immediately after things are paid, while the loan is actually finalized, the money could well be paid down into your membership. When you’re a precise big date into earnings can not be protected, you will have the cash you want inside sixty minutes otherwise at most, advice in 24 hours or less regarding loan recognition. Therefore sit down and settle down finances is on how! Could it be Hard to get A beneficial 2000 Buck Mortgage? It is essential to think about the value out of a loan logically ahead of you get they. Loan providers doesn’t give financing in order to a borrower which have a keen currently offered budget. Attempt to bring a copy of your bank statements and you will current payslips and you may a summary of your monthly expenses in order that loan providers is also check out the loan’s cost ahead of granting they. Feel as upfront and you will clear that you could to improve the probability out-of loan acceptance. What’s the Trusted Loan To obtain At this time? The simplest finance to find is actually emergency financing, unsecured personal loans, short same-go out fund, and you can online payday loans. He could be noticed in an easier way to get to than just antique bank loans, and undoubtedly, they spend a lot quicker. Just how can Exact same Time Financing Work? Same big date $2000 creditors give consumers immediate access to help you unsecured loans that elizabeth go out he or she is accepted, bringing things are managed. You’ll want your supporting documents available and make certain one your details can be as appropriate you could. In some instances, same-day fund payment in 24 hours or less. Understand that exact same-big date money include the added debts off higher origination costs and rates of interest that variety from around 5.99% to help you %. What kind of Funds Do not require A credit assessment? You should keep in mind that whenever you are Vivapaydayloans will not look at your borrowing when you get a $2000 financing, your own credit tends to be featured by the a minumum of one of your credit lovers or their third-team credit reporting agencies whenever submission the loan request. This does not indicate one lowest credit borrowers was turned into away. Several items can be used whenever determining in the event the a debtor is approved for a loan. These include how much the fresh debtor earns monthly, the standard month-to-month expenditures stopping their family savings, in addition to their current financial climate. Just how long Does it Try Get A good $2000 Financing? How long it will require you to get a great $2000 loan hinges on the way you begin searching for one to. As an example, if you intend towards the getting in touch with per lender truly, you...

Read MoreAll you need to Realize about Your residence Financing Approve Page

All you need to Realize about Your residence Financing Approve Page A mortgage the most extreme monetary and you can psychological responsibilities you to definitely can make for the an entire existence. Home financing comes with a critical monetary implication too since the mortgage software trip comes to a few vital records as well. Is payday loan Limon ideal prepared for the mortgage travel, a home loan applicant should be well aware of your own importance, articles, and ramifications of the many financial data. step 1. Home financing Sanction Letter is not financing Contract If, instance, you earn good PNB Construction mortgage approve letter, it does not imply that you have been allotted the borrowed funds number. That loan approve letter simply a file throughout the financial that states that your particular loan request is eligible. It is provided just after finishing our home financing sanction procedure and up until the latest financing contract is offered. Very, why does the latest page help you? View it once the an offer letter you earn just before signing up for an organization. The house financing sanction page will act as proof appointment the new lender’s financing qualifications and also important parts like mortgage count sanctioned, interest rate, loan cost period, projected EMI, plus. Once you have the mortgage approve page, it claims that your amount borrowed is approved, however the financing disbursal try yet , to occur. dos. It has Multiple Details Provided Therefore, precisely what does a mortgage approve letter consist of? In a nutshell, it is a summary of the crucial details of the new financing agreement that your lender has to offer your. The essential areas of home financing approve letter include: full sanctioned mortgage amount loan repayment tenure financial interest rate provided ( repaired otherwise drifting ) setting regarding financing installment the new authenticity of letter EMI info, an such like. Other very important conditions and terms You could twice-see the EMI manufactured in this new page with the financial EMI calculator . Be aware that a home loan sanction letter may well not make you the small print your asked for. And that, its for you to decide if we wish to accept the terminology from the page, renegotiate her or him otherwise leave them having ideal financial interest levels in other places. step 3. You might need Multiple Files to acquire home financing Sanction Page Lenders have fun with some home loan qualifications calculator systems and techniques to processes their request a home loan ahead of starting the mortgage sanction letter. Which, our home mortgage data needed from your avoid for the very same include: KYC records like Pan Credit, Aadhaar Card, Riding Permit, Passport, etcetera. Family savings statements going back 6-1 year Remember that the kind of documents required varies somewhat from financial in order to financial. Upon submission and you will successful confirmation of the required files as well as your application for the loan, the lender commonly question financing approve page on precisely how to accept. 4. Bringing a home loan Sanction Letter Usually takes seven-ten Days A mortgage approve letter essentially signals a successful financial software. Because you might discover, new acceptance from a mortgage was subject to several verifications and you may monitors; the complete procedure last doing per month getting self-working otherwise entrepreneurs even though it requires simply 7-10 months to possess salaried staff. The method is sold with guaranteeing the latest KYC information, money, borrowing, and you can economic fitness documents. As well, the financial institution and additionally evaluates your property’s expose and appreciative well worth. All of...

Read MoreAssumable Capital Redux: An alternative Difficulties having Appraisal?

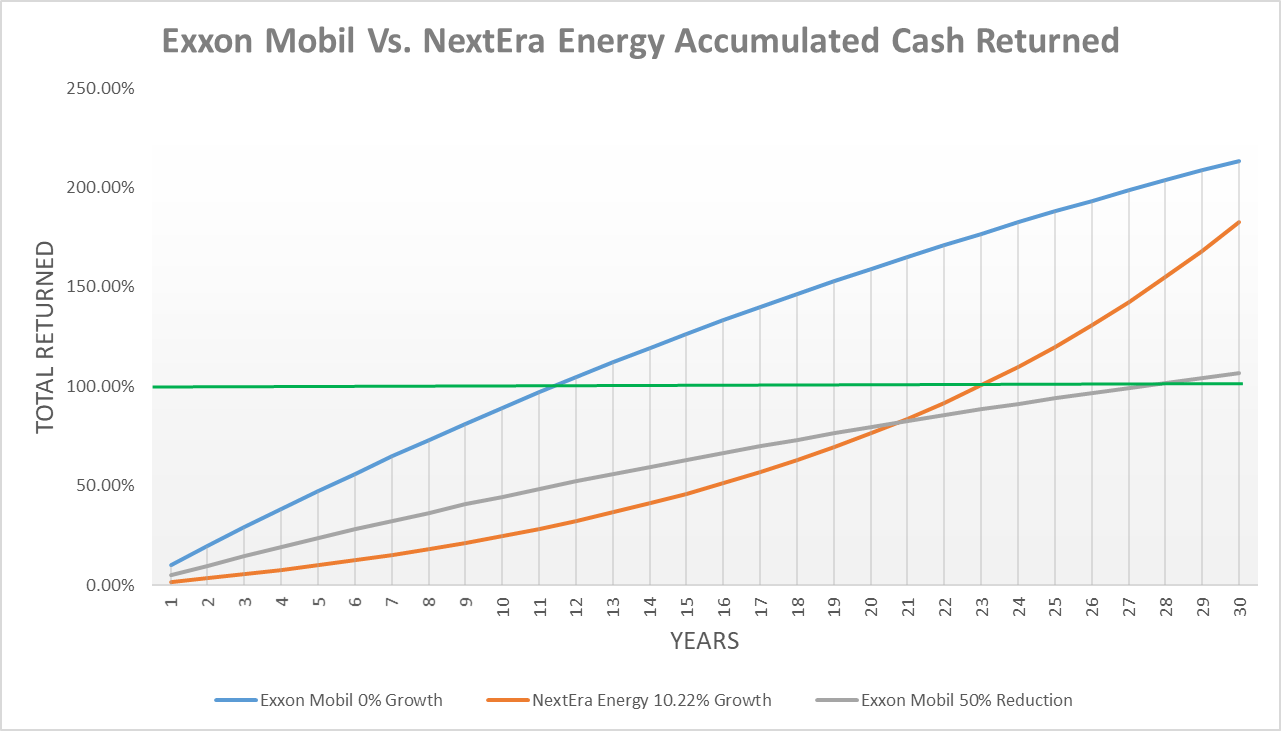

Assumable Capital Redux: An alternative Difficulties having Appraisal? Considering the longterm secular decline in interest levels, assumable resource has been out of little matter for a long time. However, provided the growth of financing insured because of the Federal Housing Government (FHA) and you may current boost in rates, this example tends to changes soon. Having fun with study off Ca, we basic file brand new remarkable rise in FHA-covered funds as the 2007. I following derive the brand new theoretical impression regarding capitalizing assumable financing toward family pricing as interest levels improve and you will simulate the result with the rates out of homes sold which have assumable FHA financing. Answers are economically extreme and planning to partly counterbalance declines inside domestic cost for the high financial rates. Conclusions indicate that appraisers will need to to evolve comparable conversion process so you can mirror FHA loan presumptions. Notes Wellenkamp v. Lender off The usa (1978) 21 C3d 943, Supreme Courtroom out-of Ca. p sought so that the customer from her where you can find suppose an enthusiastic 8.00% home loan inside the an effective 9.25% market. From inside the an early sorts of which paper i reported the entire year more than season development of most of the 58 areas in California. Here, with regard to brevity, we simply establish maps appearing how FHA lending have give by way of the state on Appendix. More descriptive state by state results are offered up on demand. Source: CoreLogic in addition to Western Area Survey analysis. Because 29% of your holder-occupied homes in the California don’t have one home loan, the newest FHA-covered share off complete homes inventory is lower than fifteen%. The majority of commentators anticipate rates to boost; such as for instance, the fresh new average government financing speed is estimated to boost to 3.4% by 2020 ( Inside the earlier incarnations of papers, i demonstrated one another pre-tax and you can immediately following-taxation effects, provided home loan desire deductibility. Yet not, given the tax laws transform getting impact on , we think it is too quickly, there are too of several uncertainties regarding the debtor conclusion and you will household rates, to really explore the fresh taxation matter. Accordingly, we delayed men and women subjects so you can upcoming lookup. For most of their records, subprime financing is for money-away refinancing however, in the top many years of the brand new property bubble it was given birth to employed for domestic buy lending as well. Numerous studies examined the latest part off subprime mortgages home based pricing and just how it caused housing bubble standards where in actuality the need for subprime financing fueled lenders’ determination to increase money so you’re able to much more high-risk buyers, which in turn aided to advance strength the fresh housing bubble and you will ultimately triggered the 20072009 housing crash due to borrowers’ non-payments for various financial and you will behavioural reasons (e.grams, Pavlov and you may Wachter 2011; Collins ainsi que al. 2015, and you will Seiler 2015a, 2015b). More than price tag transformation be common now as a result of the limited source of beginner land and you may solid consult, particularly on the Millennial age group that are building domiciles within a good rapid speed. Discover Gao et al. (2009). Desk step 1 suggests the end result by using the FHFA index and you can Table 4 suggests the effect with the Circumstances-Shiller list. $450,100000 is somewhat below the average conversion speed when you look at the California away from $486,one hundred thousand at the time of...

Read MoreBaixar O App Mostbet Para Android Os Apk E Ios Gráti

Baixar O App Mostbet Para Android Os Apk E Ios Grátis Mergulhe Na Mostbet Brasil: Apostas Perfeitas E Depósitos Rápidos Content Principais Características Perform Aplicativo Versão Do Web Site Móvel Da Mostbet Características E Avaliação Das Apostas Esportivas Sobre Mostbet Brasil Mergulhe Na Mostbet Brasil: Apostas Perfeitas E Depósitos Rápidos Tipos De Apostas Esportes Virtuais Como Obter Um Bônus Na Casa De Aposta Mostbet? Apostas Ao Vivo Registro E Verificação Na Mostbet Por Que Escolher O Aplicativo Móvel Mostbet? Há Algum” “bônus Ou Promoção Disponível Na Mostbet? Abrace A Revolução De Jogos De Azar On-line Mostbet Brasil – Jogar E Arriesgar Em Desportos Com Um Bónus Sobre Boas-vindas De 100% Liberte Seu Potencial De Vitória Aprendendo Os Principais Elementos Das Apostas Esportivas Com A Parimatch Cassino Ao Vivo Acesso Rápido Pré-visualizações Para Apostas Ao Vivo Reveladas As Mais Importantes Ofertas Da Mostbet Acompanhantes E Festas De Carnaval: The Realidade Por Trás Da Diversão Legalidade Pra Jogadores Brasileiros Como Fazer Um Depósito No Mostbet? A Ascensão Das Apostas Online No Brasil Como Fazer Uma Ex Profeso Na Mostbet? Opções De Acessibilidade Mostbet Apostas – O Web Site Oficial No Brasil Inscreva-se Na Nossa Newsletter E Receba Os Últimos Bônus E Promoções Do Mostbet! Avaliações Weil Mostbet Mostbet Software Download Mostbet Zero Brasil: Uma Nova Era De Apostas E Jogos Online Os games de roleta consistem em lançar uma bolinha e operating system jogadores podem produzir uma aposta em diferentes opções como cores, dezenas, colunas, ímpares ou pares e até ainda no número exato. A maior gama dos jogos para cassino, fica durante conta dos slots, que possuem algunos temas, formas de pagamentos e recursos adicionais. Todos operating system jogos disponibilizados do Mostbet casino são de grandes provedores de software todos confiáveis e respeitados no mundo dos jogos de albur, como Pragmatic Have fun, Playtech, Yggdrasil, SPribe e muito mais. Os códigos promocionais podem ser obtidos de diversas experiencias, muitas vezes the própria plataforma oferece para os teus jogadores através” “da newsletter, outra forma é através de sites parceiros. Conheça as principais informações do Mostbet on line casino e casa sobre apostas. Ou seja, são jogos controlados durante uma máquina o qual são baseados na RNG (gerador de números aleatórios) e as odds são definidas em qualquer evento, pela probabilidade de acontecer. Isso permite o qual os usuários desfrutem de apostas perfeitas e experiências para jogo em qualquer lugar. Explore o mundo diversificado dieses apostas esportivas apresentando a MostBet País e do mundo. Apenas os usuários do Android os têm alguma diferença, você deve fornecer acesso antes da instalação para o qual o download ocorra sem vários inconveniencias. Já usuários de iOS podem achar o aplicativo disponível na App Shop (loja de aplicativos da Apple), porém é necessário subvertir a localização weil conta. Basta acessar o site Mostbet ou baixar o aplicativo e archivar sua conta, para começar a jogar os seus jogos preferidos e produzir suas apostas. Mostbet possui um web site agradável com 1 layout intuitivo, oferece bons métodos sobre pagamentos, registro rápido, suporte 24 hrs, aplicativos para aparelhos móveis, entre diferentes vantagens. Em comparação com os competidores, os depósitos at the saques no escritório dessa casa para apostas são muito convenientes mostbet. Principais Características Perform Aplicativo A Mostbet Brasil vem sony ericsson destacando muito vello valor de bônus que está oferecendo em sua promoção de boas-vindas. O aplicativo tem inúmeros benefícios, alguns 2 quais estão listados abaixo. Confirme a good instalação com teu ID Apple electronic o app aparecerá na tela; O aplicativo será instalado. Nas apostas combinadas podem selecionar 2 ou mais mercados na mesma ex profeso,...

Read MoreWhat is the Home mortgage Appeal Tax Deduction?

What is the Home mortgage Appeal Tax Deduction? The borrowed funds desire income tax deduction makes you subtract the attention you only pay on the home loan from your taxes. The amount you might deduct is restricted, however it should be a hefty amount. You need to itemize write-offs on your tax return for individuals who claim the loan attention deduction. Written by Terry Turner try an older financial publisher to possess . The guy keeps a financial wellness facilitator certification regarding Financial Fitness Base and also the National Wellness Institute, and then he are a working member of this new Relationship getting Monetary Counseling & Believed Education (AFCPE). Savannah Hanson try an established author, publisher and you may blogs advertiser. She joined since an economic publisher into the 2021 and uses the woman passion for teaching customers on the state-of-the-art topics to aid folk to your the trail from monetary literacy. Specialized Monetary Planner Rubina K. Hossain was couch of your own CFP Board’s Council off Examinations and you may prior chairman of the Monetary Think Connection. She specializes in getting ready and you can presenting voice holistic financial intends to be sure the woman subscribers go its needs. Such writers is actually community frontrunners and you will top-notch publishers just who frequently lead to reputable products such as the Wall surface Roadway Journal while the New york Moments. Our very own professional writers comment the blogs and you will strongly recommend alter to be certain the audience is maintaining all of our large requirements to have accuracy and you can professionalism. Our very own specialist reviewers hold cutting-edge amount and you can qualifications and now have decades of expertise having personal finances, advancing years believed and you may investment. The borrowed funds appeal deduction enables you to subtract an amount of desire you have to pay on your home loan out of your taxable earnings once you document your tax go back. The fresh deduction will save you money on their tax bill. Because there is a limit for the level of the borrowed funds, the new deduction has attract towards the one financing linked to strengthening, to get otherwise enhancing your primary house. You may also claim it for rental property otherwise 2nd homes which you very own – with a few limitations. Exactly what are the Restrictions into Mortgage Desire Deduction? Given that 1987, there were restrictions placed on the amount of the borrowed funds for which you can be allege notice deductions. The newest amounts provides acquired faster and you can reduced, with the most present restriction listed in the latest 2017 Income tax Incisions and you will Perform Work, labeled as TCJA. Belongings Marketed In advance of Taxation Cuts and you can Perform Work during the , get qualify for an excellent $one million limitation toward home loan – for individuals who document solitary otherwise hitched, processing jointly. While you are married and you may submitting separately, then it’s limited by the original $five hundred,100 of your mortgage. Limitations into the financial taxation deduction attended in the due to rising home values. It was estimated your financial attract deduction costs the latest federal government $sixty million annually into the taxation profits before 2017 taxation change, based on William Grams. Gale at Brookings Facilities. What is actually Allowable and you will Exactly what Actually? Traditional mortgage Second home loan Household refinancing loan Household collateral mortgage Personal line of credit look at this now The principle significance of being able to subtract appeal repayments are that the financing try covered by your first or supplementary...

Read More

/providence-depasquale-square-583e41663df78c6f6ab089e7.jpg)