7 Best Free QuickBooks Alternatives for Business Accounting in 2024

The biggest advantages to using QuickBooks are ease of use, seamless integrations and ubiquity. So, many businesses have adopted QuickBooks, so it can be helpful to use the same software as clients, depending on the type of business you run. However, there are many alternatives to QuickBooks that cost less and have similar features that can work for your needs. The HubSpot Customer Platform The ability to connect your accounting software to other business programs you use saves you valuable time because you don’t have to manually transfer data from one system to another. Integration with systems you already use also cuts down on training time for employees who will use the software. Zoho Books emerges as a potent accounting software, offering a plethora of advanced functionalities and robust invoicing capabilities, all at a fraction of QuickBooks’ cost. Despite its budget-friendly pricing, Zoho Books doesn’t skimp on features, rivaling even some of the pricier alternatives in the market. This helps you keep a tab on your finances and business while you are on the move. What are the important features of free accounting software? Our favorite features that we tested during our review of Zoho Books included its support for 1099 contractors, overall usability and customization options. Our favorite features in our test of Xero included its tools for bill pay management, its customizable dashboard and its bookkeeping features. Our favorite QuickBooks Online features that we tested are its customizable dashboard, comprehensive reporting tools, and accountant and bookkeeper integrations. The best accounting software makes managing your books easy, with precision accuracy and efficient automation. In essence, Wave Accounting emerges as a formidable QuickBooks alternative, especially for businesses keen on optimizing costs without sacrificing core accounting functionalities. For those on the hunt for an economical solution to manage their small business finances, Sage Accounting emerges as a commendable QuickBooks alternative. Best for tight budgets: Wave Accounting Zoho Books leads our roundup of the best QuickBooks alternatives because it’s similar to QuickBooks Online but has a more functional mobile app. Among its many useful features are the ability to receive payments, send invoices, record time worked, capture expense receipts, and view reports from your mobile app. Real-time inventory tracking and mobile payments further enhance Striven’s accounting tools. However, Striven does not provide a mobile cash receipts crossword clue app or native payroll system; both of these features are readily available in QuickBooks Online. Accounting software is used to extract data from large tax documents, create new journal entries, track payments, send invoices, and eliminate manual data entry. Automation can provide enormous time savings for finance departments that total thousands of hours annually, which is another reason to consider implementing accounting software. Wave Accounting gives you access to a fully-featured free plan, where you can manage your inventory, create customizable receipts, and file your taxes quickly. With FreshBooks, you get access to a free 30-day trial, where you can send unlimited estimates, track your mileage, send unlimited invoices, and customize your email signature. While the platform does offer advanced features to manage your financing and books, it is not specific to an industry. In this case, we put eight accounting software products to the test across 111 areas of investigation. Zoho offers a bare bones free plan, which is attractive to anyone that’s ever heard of money. Financial Reporting It’s also a good choice for businesses with employees who need to track billable hours—it includes time tracking on all plans. Then QuickBooks might be worth the money—its accounting app is rated higher than most competitors’, and we’re pretty sure you’ll love its...

Read MoreWhat Is the Accounting Equation Formula?

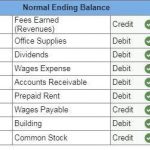

In this form, it is easier to highlight the relationship between shareholder’s equity and debt (liabilities). As you can see, shareholder’s equity is the remainder after liabilities have been subtracted from assets. This is because creditors – parties that lend money such as banks – have the first claim to a company’s assets. For example, an increase in an asset account can be matched by an equal increase to a related liability or shareholder’s equity account such that the accounting equation stays in balance. Alternatively, an increase in an asset account can be matched by an equal decrease in another asset account. Financial statements It is used to transfer totals from books of prime entry into the nominal ledger. Every transaction is recorded twice so that the debit is balanced by a credit. A company’s quarterly and annual reports are basically derived directly from the accounting equations used in bookkeeping practices. These equations, entered in a business’s general ledger, will provide the material that eventually makes up the foundation of a business’s financial statements. This includes expense reports, cash flow and salary and company investments. This equation holds true for all business activities and transactions. Shareholders’ Equity Every transaction is recorded twice so that the debit is balanced by a credit. Like the accounting equation, it shows that a company’s total amount of assets equals the total amount of liabilities plus owner’s (or stockholders’) equity. Drawings are amounts taken out of the business by the business owner. The accounting equation will always balance because the dual aspect of accounting for income and expenses will result in equal increases or decreases to assets or liabilities. One of the main financial statements (along with the balance sheet, the statement of cash flows, and the statement of stockholders’ equity). The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations. The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown in the heading of the statement. If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement. Examples of assets include cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill. The relationship between the accounting equation and your balance sheet Speakers, Inc. purchases a $500,000 building by paying $100,000 in cash and taking out a $400,000 mortgage. This business transaction decreases assets by the $100,000 of cash disbursed, increases assets by the new $500,000 building, and increases liabilities by the new $400,000 mortgage. A liability, in its simplest terms, is an amount of money owed to another person or organization. The cash (asset) of the business will increase by $5,000 as will the amount representing the investment from Anushka as the owner of the business (capital). We will now consider an example with various transactions within a business to see how each has a dual aspect and to demonstrate the cumulative effect on the accounting equation. Equity represents the portion of company assets that shareholders or partners own. In other words, the shareholders or partners own the remainder of assets once all of the liabilities are paid off. Now that we have a basic understanding of the equation, let’s take a look at each accounting equation component starting with the assets. Owners can increase their ownership share by contributing money to the company or decrease equity by withdrawing company funds. For example, if a company becomes bankrupt, its assets are sold and these funds are used to settle its debts first....

Read More