Table of Content

Virtual assistant funds offer qualified borrowers an excellent mortgage solution. With its zero-off nature, the mortgage system has the benefit of an easily affordable path to homeownership. However,, as with any home loan, borrowers need level home prices against the personal finances. Therefore, we shall make use of this article to resolve issue: having a great Va loan, how much do i need to manage?

- Va Financing Evaluation

- Products Affecting How much Virtual assistant Financing You really can afford

- Most Va Loan Affordability Factors

- Conclusions

Va Loan Overview

Within the original setting, the new Virtual assistant loan offered troops returning away from The second world war an affordable mortgage alternative. Today, the fresh new Agencies off Pros Items administers the borrowed funds program. But, contained in this ability, the latest Virtual assistant doesn’t in fact lend currency. As an alternative, they pledges a portion of all of the financing approved by the Virtual assistant-accepted lenders (e.g. banks, borrowing from the bank unions, home loan people, etcetera.).

So it regulators ensure minimizes chance of these lenders. Alot more accurately, if the a debtor defaults, the brand new Virtual assistant tend to refund the lender the main a fantastic mortgage equilibrium. Due to this fact shorter chance, loan providers could offer the fresh new less than a good terms and conditions to have Va money:

- No advance payment expected

- No personal mortgage insurance (PMI) necessary

- Low interest rates

- Streamlined refinancing choice via the Interest Cures Refinance loan (IRRRL)

Things Affecting How much cash Sanford loans Va Loan You can afford

not, maybe not requiring an advance payment does not always mean consumers can afford due to the fact high from a beneficial Va mortgage as the they’d instance. Instead, brand new Virtual assistant imposes clear guidelines about how much an individual can borrow, dependent on their particular overall economic photo. And you can, because of the skills these tips, certified individuals normally determine how higher off a good Va loan they are able.

Va Loan Obligations-to-Money Ratio

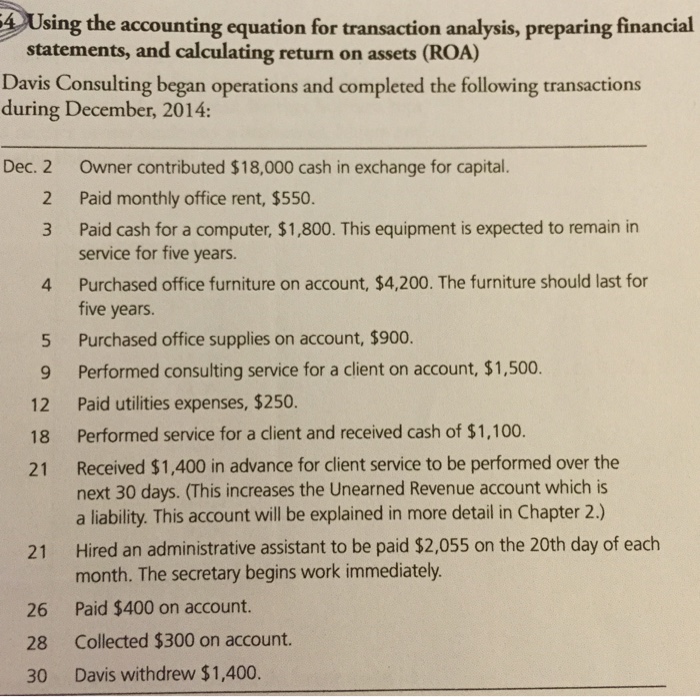

The primary metric influencing how big a good Virtual assistant financing was called personal debt-to-income ratio, otherwise DTI. Statistically, you could dictate the DTI by taking all month-to-month loans costs (as well as your future mortgage repayment) and you can dividing one overall by the month-to-month terrible (pre-tax) income.

Instance, say you may have a good $250 vehicle payment, $250 in education loan money, and good $step 1,five hundred home loan for $2,one hundred thousand overall ($250 + $250 + $step 1,500). Now, imagine you have $step 3,500 from inside the terrible month-to-month income together with $step 1,500 for the BAH having $5,000 total ($step 3,five-hundred + $1,500). In this example, the DTI would-be 40% ($2,one hundred thousand inside monthly debt costs / $5,one hundred thousand into the monthly gross income).

With respect to the Va, borrowers fulfill credit standards with DTIs up to 41%. If you find yourself borrowers which have ratios greater than 41% can be be considered, these fund need a lot more scrutiny from the Va.

Having said how DTI calculations functions, we will details how consumers is determine its restrict monthly installments. Basic, you need to make sense your full month-to-month revenues. Imagine its $six,one hundred thousand. Next, you will want to multiply one to count from the 41%. Thus giving the limitation number of month-to-month overall financial obligation payments you’ll have. In this instance, $six,000 x 41% translates to $2,460.

However,, think about, which full is sold with all your valuable monthly loans costs. As such, you 2nd must subtract any low-mortgage payments. By way of example, guess you really have an effective $460 monthly car payment. Now, you realize that full homeloan payment (dominant, desire, insurance, assets tax, and you can, if the associated, homeowner’s relationship fees) you should never exceed $dos,one hundred thousand ($dos,460 $460).

Deciding Mortgage Affordability

If you know the quantity you can dedicate to monthly mortgage payments, you can calculate what size out-of a good Virtual assistant loan you might afford. However,, this involves particular presumptions on the rates of interest, insurance coverage, and you can assets taxation (imagine getting example’s sake zero HOA repayments). And you can, the loan officer helps you imagine these ple, guess another: