Maintaining a minimal DTI ratio helps you safe mortgage approval

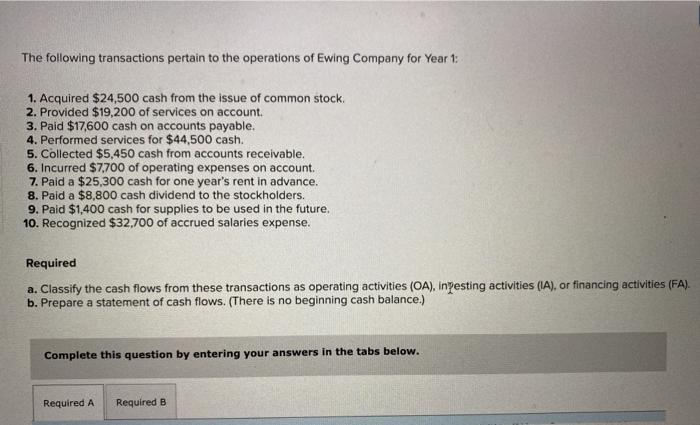

Maintaining a minimal DTI ratio helps you safe mortgage approval Pigly’s Idea! Read the money restriction in your part by the being able to access brand new USDA income restrictions page. At the time of , the standard money restrict so that you can four-representative home into the You.S. areas is $90,300. Meanwhile, money constraints for 5 to 8-member property is set at the $119,two hundred. Debt-to-Income Ratio Individuals need certainly to match the called for loans-to-income ratio (DTI). DTI is a percentage one tips the total month-to-month loans costs along with your overall monthly earnings. Pay attention to the one or two main variety of DTI ratios: Front-stop DTI This is basically the portion of your earnings that purchase every mortgage-associated can cost you. It includes monthly obligations, assets taxes, relationship dues, homeowner’s insurance rates, etc. To possess USDA fund, your front side-avoid DTI must not surpass 31 per cent. Back-prevent DTI Here is the part of your income you to definitely buy home loan expenses together with your other bills. It gives your car financing, credit card debt, personal loans, an such like. So you’re able to qualify for good USDA financing, your back-stop DTI shouldn’t be more than 41 %. DTI conditions to have USDA fund seem to be similar to traditional mortgages. That it sign assists loan providers assess while a decreased-chance borrower. A reduced DTI proportion form lower danger of defaulting on the mortgage, and therefore increases the possibility for loan acceptance. Yet not, sometimes, a good USDA financial may accept a higher DTI ratio if for example the credit rating exceeds 680. Just how much do you obtain? It will confidence the total amount you can qualify for. This is according to monetary factors just like your paycheck, expense, and your credit rating. USDA money dont impose mortgage restrictions. At exactly the same time, most other bodies-recognized mortgage loans like FHA finance enforce specific mortgage limitations for every urban area. USDA Ensure Commission USDA borrowers must pay mortgage insurance coverage known as ensure payment. This is certainly required if you make virtually no down payment on your own mortgage. This new guarantee fee is actually repaid each other given that an initial fee and a yearly make certain percentage that’s rolled into your monthly premiums. The newest initial verify fee is actually 1% of your own amount borrowed, once the annual be sure payment are 0.35% of your dominating mortgage balance. As an example, if for example the financing was $3 hundred,100000, the fresh initial make sure fee is $step 3,000. For your own annual be certain that fee, should your prominent harmony try less so you’re able to $280,000, it would be $980 ($ a month). Consequently as your prominent balance minimizes, your yearly verify fee as well as minimizes. Yet not, bear in mind that yearly ensure percentage is needed into the expereince of living of your own financing. In lieu of conventional mortgage loans, mortgage insurance policy is simply you’ll need for a finite time period. USDA mortgage insurance coverage was all the way down as compared to other government-recognized mortgages, instance FHA money (step 1.75 per cent to have initial fee). The lower insurance coverage were implemented into ent. Before the new costs, the fresh new USDA upfront be certain that commission try dos.75 percent, once the annual verify fee is 0.50 Byers loans %. Data files getting Software or other Will cost you Same as conventional finance, USDA individuals need certainly to yield to borrowing from the bank inspections till the loan are approved. Expect you’ll tell you...

Read MoreFour Methods to adopt When Comparing Financial Forbearance

Four Methods to adopt When Comparing Financial Forbearance Regarding the wake of your own monetary chaos and highest jobless profile produced by the fresh new COVID-19 pandemic, lenders sought after a means to assist customers weather the instant violent storm. Advice originated in the brand new Coronavirus Support, Rescue, and you can Financial Safety (CARES) Work, and that composed extremely important defenses for financial consumers. If for example the mortgage was backed by a government entity particularly Federal national mortgage association, Freddie Mac computer, HUD, USDA, or the Veterans Management and you’re sense adversity on account of brand new pandemic, you’ll be able to consult doing 12 months-several 180-big date attacks-off home loan forbearance. Going for forbearance fundamentally makes you pause repayments to possess an occasion of energy. If the home loan is not authorities-backed, the bank may offer relief choice toward an incident-by-circumstances base if the earnings might have been inspired. Five Measures to take on Whenever Evaluating Financial Forbearance Shop around When considering mortgage rescue choice, understanding the terminology and processes is crucial. Forbearance enables you to end to make costs to have a period of big date as opposed to penalty, but it is perhaps not forgiveness. You still owe the main, attention, escrow, and other elements of the loan adopting the forbearance period was over. Forbearance is even not deferment, where in actuality the paused money try set in the termination of brand new loan’s name, no matter if that can easily be you to option for a fees plan shortly after your own forbearance months ends up. Whenever you can build partial or full money for the forbearance period, that will help you slow down the matter you borrowed if the period is more than. Five Steps to adopt Whenever Contrasting Financial Forbearance Improve request Forbearance isnt automated. You should request it. Of several financial institutions was handling a formidable number of requests, so it’s a good idea to play with on the web devices preferably. You will likely not have to provide all other documents. Within the CARES Act, government-recognized money need an initial forbearance age 180 months. So you can consult a supplementary 180 weeks, you should make a second request until the very first 180-day several months ends. Five Tips to take on When Comparing Mortgage Forbearance Include debt really-are Forbearance can help you defeat quick-label monetary setbacks, such as a short-term occupations loss or a reduction in occasions, and keep maintaining your house in place of adversely affecting your credit history. Their mortgage lender won’t fees late costs and other penalties through the new forbearance several months. Those people that was indeed analyzed to own missed money in front of you entering for the forbearance and never but really paid back will continue to remain on the fresh account. Most of the time, in the event the home insurance and you may a home taxation are part of the mortgage, they will be state-of-the-art by your servicer when you’re into the forbearance. If they’re perhaps not integrated, try to keep spending your home insurance while you’re in forbearance and make contact with your local government in the work deadlines and options for your own income tax repayments. Four Methods to consider When Comparing Mortgage Forbearance Package your following procedures Just before their forbearance months ends, your lender work along with you to determine your absolute best second steps. Your options range between a good: Mortgage loan modification- This could include an extension towards prevent of your own mortgage otherwise a modification on rate and you can identity to pay the...

Read MoreReliable Rates The bottom FICO analysis criteria is based on the home financing

Reliable Rates The bottom FICO analysis criteria is based on the home financing Consumers Beneficiaries can put on online or one on one any kind of time of its locations. Visitors assistance is obtainable Saturday-Tuesday, 0: 0 CST, and 2 was CST on the Saturdays. (Top ten Greatest Mortgage lenders) Reputable rates render home loans for the several people and you may refinancers. The tool offering includes fixed and you may movable rates agreements (ARM), normal and type-measurements of contracts, FHA, USDA, and you can Virtual assistant enhances, in addition to money just mortgage brokers. 7. LoanDepot LoanDepot is just one of the most significant non-lender deal moneylenders in the usa, within more than 150 twigs and you can a robust net-situated presence. Their things utilize traditional home loans, government-upheld credit, and you can rescheduling. Members just who incorporate NDR’s Melo SmartLoon online innovation can also be disappear their prevent big date from the 17 weeks by the diminishing desk work and you may very carefully associating and confirming resources, pay, and you will interfacing. Additionally, Melo SmartLone can cautiously manage title clearances, that is occasionally among big date-escalated stages in the latest encouraging program. An added benefit http://cashadvanceamerica.net/2000-dollar-payday-loan of so it advancement would be the fact it determines in the event that specific borrowers’ beneficiaries can also be delay new research requirement, which can save time and you will a few hundred dollars away from your home financing can cost you. Debtor candidates can use on the web otherwise during the in excess of 150 components of the latest U.S. Progress Prevent. You will find currently focuses of originating in Arizona, Tennessee, as well as 2 California, as they are at this time subscribed during the 50 claims. London clients can apply on the web having a mortgage. Whenever they keeps shown its software, a cards manager often consult that they glance at the adopting the amounts, and additionally distribution pay suggestions and you can personal recognizable research. (Top 10 Most readily useful Lenders) Toward low-weekend days, buyer support minutes is responsibly flexible, Monday owing to Monday and Tuesday off eleven good.m. in order to ten p.yards. LoanDepot’s financial pre-endorsement time needs to 20 minutes to have supporters who are in need of in order to promote a lot more study. (Top 10 Better Lenders) Beneficiaries just who incorporate its Melo SmartLoan innovation, that is believed to decrease the level of table really works candidates fill in and you may, occasionally actually wipe out the requirement getting a home assessment, normally abbreviate the past communications of the as long as 17 months. Normal and you can Va home enhances require a base FICO rating out of 620, the conventional needs for some banking companies. To own FHA agreements, the credit requirement are quicker significant, which have 580 at the least plungings. Finally, gigantic individuals beneficiaries need to have a base FICO get regarding 700. 8. PenFed Borrowing Partnership Weeks to close: 31 to help you forty days to own get closings, albeit the bank is also oblige far more short-time symptoms if necessary Established in 1935, PenFed is amongst the most significant pieces-had credit contacts in the united kingdom. Penfed has actually an open contract, hence implies zero tactical endorsement needs.Going additionally, you want to open and maintain an offer (financial support account) with in any feel $ 5. It’s not a registration expenses, its a good part’s arms share, plus the requirements are no different for every single area. Price individuals have to pay no expenditures; He is only responsible to possess outsider charges, such, valuation, label,...

Read MoreHow can i qualify for a mortgage?

How can i qualify for a mortgage? Be it your first domestic or you may be a professional experienced inside the the real estate markets, the house mortgage techniques seems like a frightening task to deal with, nevertheless doesn’t have to be tough or confusing. Knowing the procedures and you may conditions of the house financing procedure will make it much easier for you. step one. Qualifying Step one yourself mortgage process try qualifying to possess financing. Whenever being qualified to have a mortgage, there are some things loan providers take into consideration whenever determining just how far currency they may be able manage to provide you. Many people keep a myth that the merely situation loan providers consider can be your credit rating, and therefore a poor credit get mode you will not qualify for a great, affordable mortgage. While you are your credit rating and you will record is actually examined, other factors as well as change the amount of cash possible be eligible for inside home financing. Among the many bigger issues when qualifying for a mortgage try money stability. Loan providers want to know that you’re and make adequate money to blow straight back your loan, and that your earnings are steady and you will uniform. In place of proof of earnings stability, loan providers will not feel at ease offering you a life threatening financial. Close to earnings balance, your financial obligation is factored towards the picture. Even with steady, uniform money, if your number of debt your debt is superb, they ount you would like. The next important aspect for the being qualified to have home financing is their borrowing from the bank. Your credit rating and your credit history could well be drawn on the account to determine if home financing are possible for one another on your own and your lender. The higher your credit rating, the greater a loan provider have a tendency to feel at ease credit your, and the top interest levels your loan will carry. Fico scores become since the a surprise for many of us; many imagine their credit rating was lower than it really is. not, even with a less-than-prime credit rating or credit rating, apps come in place to let some body improve their credit ratings and also have the house funds they want. Your credit score will establish the type of home loan you to shall be accessible to you. The third basis believed ‘s the loan really worth pertaining to new worth of our house. Depending on the sorts of loan you are offered, there can be a fixed minimal necessary because a down-payment. Your own downpayment could well be computed in line with the value of our home as well as the style of financing you are receiving since the a result of your credit score. Just how much can i qualify for? Before applying to possess a mortgage, you can ponder how much you could be eligible for. Will, extent a loan provider commonly meet the requirements your having try much better than it is possible to feel safe paying into a different loan. When the number have decided, loan providers essentially show the most you are eligible to discovered considering your income, credit history and you may background, therefore the worth of the house. Once understanding what you are able qualify for, you can works your path down seriously to online payday loans Bark Ranch CO that loan you to definitely you then become more comfortable expenses. Including, i assist you to talk about your financial budget and arrange...

Read MoreHouse Repair Money Revision the worth of Your residence

House Repair Money Revision the worth of Your residence It is hard to trust we are nearly halfway as a consequence of summer. Yes, into extended pandemic, the sense of energy is actually altered. Like other Ontario homeowners, enough time might have crept up-and try pushing one to understand what must be done to your residence in order to change and improve one nagging troubles unaddressed in the level of your own pandemic. Maybe you’ve already been thinking about finishing off the basements to put for the a home work environment. With and a lot more home owners working at home and you may companies thinking about cutting inside-office hours, the necessity for property place of work is more than previously. Maybe the lawn contains the possibility to landscaping and you can modernize. Your kitchen can certainly be looking for a makeover. No matter what repairs and you can domestic renovations a resident can be thinking about truth be told there remains a standard motif that can not eliminated. Just how do you realy fund a house repair? For these property owners that can has less than perfect credit, practical question along with comes up on how tend to loan recognition works to pay for any house repair will cost you? By experiencing present equity on the possessions, you can find house recovery second mortgages that shelter this new required rates with it. Less than perfect credit consumers can also turn-to individual loan providers (C loan providers) so you can negotiate private mortgage selection. An exclusive domestic recovery loan will help to defense the expenses of every condition and you may home improvements from the along with being able to access available equity of your home. Ontario Lending products to aid Fix the expenses You can rest assured one to considering the time and money, a renovation will eventually enhance the property value your property. Predicated on Genworth Canada, the area of your home that can offer the most readily useful financing return and ultimately help the appraised value of your house includes: New basement The kitchen One bathrooms you could check here This means that, for those who dedicate state 10,100000 within the renovation costs to upgrade your cooking area might generate straight back this number for the security and much more when your house is appraised for the current market worthy of. Yes, the original upfront cost will there be, although not, the possibility to increase the general worth of your home is most likely. Of these homeowners one to understand the worth of household renovations but may feel out-of less than perfect credit, financial loans are present to offer the ways to buy people required home improvements. Inside Ontario, the borrowed funds business will identify loan providers for the about three wide classes: A lenders B Lenders C Lenders The first sounding loan providers consists of the big banking institutions. Bank mortgages need exemplary credit, an inclination for easy-to-estimate annual income, adequate most financial property, and you will a reduced loans ratio. Loan providers regularly lay home owners/borrowers as a consequence of rigorous financial be concerned evaluating which have been tightened up actually next at the time of . Next category of loan providers includes faith enterprises and credit unions. Regardless if much more easy regarding credit standards than simply the A good financial competitors, these lenders create however wanted a credit score with a minimum of 550 and you may favor effortless-to-estimate family earnings and additionally any additional financial property. Individual lenders make up the third group of C loan providers. For those that might...

Read More